Financing for Plumbing and Plumbing Repair Through J Rowe Plumbing Inc.

This is an application to obtain financing for your plumbing equipment installation. Please fill out all of the applicable spaces and hit the “submit” button below. One of our associates will be in touch with you shortly to verify the information that you have provided.

The GreenSky® Loan Program’s focus is simple – to help

you achieve the home of your dreams! The GreenSkyⓇ

Program offers a streamlined and convenient way to pay for

many home improvement projects.

- Select Plan Option

Easy, Paperless Application - Apply via the Mobile App

Or by Phone: 866-936-0602

Fixed Rate 7.99% – 19.99% APR for 120 Months

Plan#

99921

APR

7.99% -19.99%

Months

120 Months

Example Project Cost

120 Monthly Payments of:

$5k

$96.59

$10k

$193.19

$20k

$386.38

No Interest if Paid in Full Within 12-Month Promo Period, With No Payments Required

Interest is billed during promo period but will be waived if the amount financed is paid in full before promo period expires.

Plan#

25212

APR

15.85% -21.19%

Months

12 Months

Example Project Cost

84 Monthly Payments of:

$5k

$141.41

$10k

$282.80

$20k

$565.60

No Interest if Paid in Full Within 15-Month Promo Period, With No Payments Required

Interest is billed during promo period but will be waived if the amount financed is paid in full before promo period expires.

Plan#

4158

APR

17.99% -24.99%

Months

15 Months

Example Project Cost

69 Monthly Payments of:

$5k

$126.53

$10k

$253.05

$20k

$506.11

Frequently Asked Questions About the GreenSky® Program

Q: Why should I finance my project when I can pay cash or use a credit card?

Financing a project may allow you to spread out the expense and enable increased buying power to fulfill your ideal project.

Q: What type of credit is available?

GreenSky® Program loans are unsecured installment loans with APRs that become fixed once the loan enters its amortization period.

Q: Where can I use my loan?

Working with a GreenSky® Merchant, qualified applicants can use loans to pay for products and services to complete their residential project.

Q: How do I pay my contractor?

After your contractor requests a payment, you will receive a text message or email to authorize the transaction.

Q: How long do I have to use my loan?

Once approved, and depending on your plan, you typically have up to six months to make your purchases and approve transactions. Please refer to your loan agreement for details.

Q: When is my first payment due?

It depends on your loan plan. There are a range of plans available through the GreenSky® Program, some of which offer deferred or reduced payments during a promotional period. Since plan types may vary, however, you should refer to your loan agreement for specific loan terms.

There is no prepayment penalty for early loan payoff.

Q: How do I make a payment?

It’s simple – pay online in the customer portal or by phone, or schedule automatic payments to be drafted from your bank account. The choice is yours.

GreenSky® Financing Plans and Terms

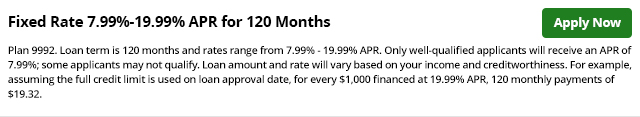

Plan 9992

Subject to credit approval. Loan term is 120 months and rates range from 7.99% – 19.99% APR. Only well-qualified applicants will receive an APR of 7.99%; some applicants may not qualify. Loan amount and rate will vary based on your income and creditworthiness. For example, assuming the full credit limit is used on loan approval date, for every $1,000 financed at 19.99% APR, 120 monthly payments of $19.32. This example is an estimate only. Actual payment amounts based on amount and timing of purchases. Call 866-936-0602 for financing costs and terms.

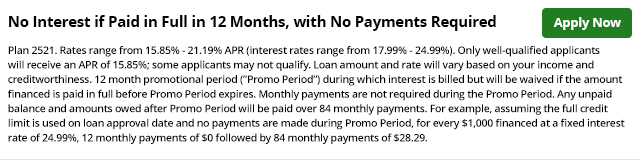

Plan 2521

Subject to credit approval. Rates range from 15.85% – 21.19% APR (interest rates range from 17.99% – 24.99%). Only well-qualified applicants will receive an APR of 15.85%; some applicants may not qualify. Loan amount and rate will vary based on your income and creditworthiness. 12 month promotional period (“Promo Period”) during which interest is billed but will be waived if the amount financed is paid in full before Promo Period expires. Monthly payments are not required during the Promo Period. Any unpaid balance and amounts owed after Promo Period will be paid over 84 monthly payments. For example, assuming the full credit limit is used on loan approval date and no payments are made during Promo Period, for every $1,000 financed at a fixed interest rate of 24.99%, 12 monthly payments of $0 followed by 84 monthly payments of $28.29. This example is an estimate only. Actual payment amounts based on amount and timing of purchases. Call 866-936-0602 for financing costs and terms.

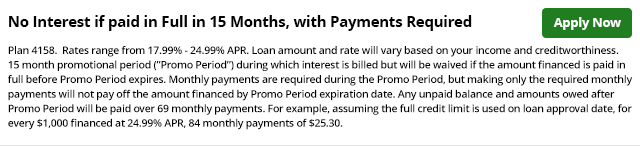

Plan 4158

Subject to credit approval. Rates range from 17.99% – 24.99% APR. Only well-qualified applicants will receive an APR of 17.99%; some applicants may not qualify. Loan amount and rate will vary based on your income and creditworthiness. 15 month promotional period (“Promo Period”) during which interest is billed but will be waived if the amount financed is paid in full before Promo Period expires. Monthly payments are required during the Promo Period, but making only the required monthly payments will not pay off the amount financed by Promo Period expiration date. Any unpaid balance and amounts owed after Promo Period will be paid over 69 monthly payments. For example, assuming the full credit limit is used on loan approval date, for every $1,000 financed at 24.99% APR, 84 monthly payments of $25.30. This example is an estimate only. Actual payment amounts based on amount and timing of purchases. Call 866-936-0602 for financing costs and terms.